New GST Rates 2025: A Diwali Gift for Common Man

Discover how the 22 Sep 2025 GST cuts save you money on daily essentials, healthcare & more. Learn how to update Tally for seamless compliance.

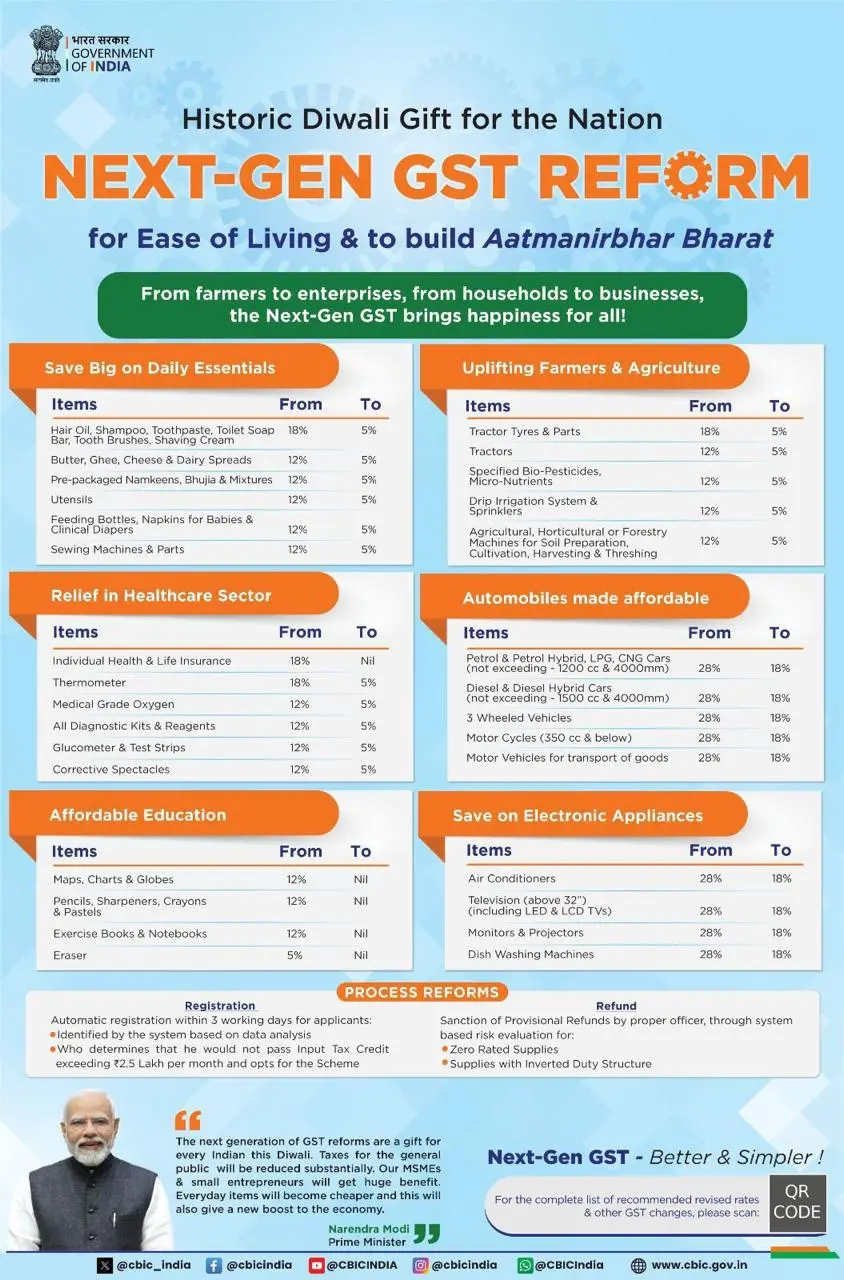

The Government of India has truly delivered a historic Diwali gift to the nation! Announced as a “Next-Gen GST Reform,” the sweeping changes to the Goods and Services Tax (GST) structure, effective from 22nd September 2025, are designed for ease of living and to strengthen our journey towards an Aatmanirbhar Bharat.

From the food we eat to the cars we drive, from healthcare to education, these revised GST rates promise to put money back into the pockets of the common man and provide a significant boost to small businesses and MSMEs.

In this detailed guide, we’ll break down exactly what these changes mean for you and your family’s monthly budget. Plus, if you’re a business owner using Tally, we’ll walk you through the essential steps to manage this transition smoothly and avoid any compliance hiccups.

A Deep Dive into the New GST Rates: How Your Wallet Gets Heavier

Prime Minister Narendra Modi stated that these reforms will make everyday items cheaper and provide a huge benefit to entrepreneurs. Let’s see how that translates into real-life savings.

Save Big on Daily Essentials (Kitchen & Home)

The most immediate and felt impact will be on everyday household items. Many products have seen a significant reduction from 18% and 12% down to just 5%.

| Items | From | To | Change |

|---|---|---|---|

| Hair Oil, Shampoo, Toothpaste, Toilet Soap | 18% | 5% | -13% |

| Butter, Ghee, Cheese & Dairy Spreads | 12% | 5% | -7% |

| Pre-packaged Namkeens, Bhujia & Mixtures | 12% | 5% | -7% |

| Utensils | 12% | 5% | -7% |

| Baby Care Products (Feeding Bottles, Napkins, Clinical Diapers) | 12% | 5% | -7% |

| Sewing Machines & Parts | 12% | 5% | -7% |

Relief in the Healthcare Sector

In a move that prioritizes public health, several critical healthcare items have seen tax reductions.

| Items | From | To | Change |

|---|---|---|---|

| Individual Health & Life Insurance | 18% | Nil | -18% |

| Thermometer, Medical Grade Oxygen | 18% | 5% | -13% |

| All Diagnostic Kits & Reagents | 12% | 5% | -7% |

| Glucometer & Test Strips | 12% | 5% | -7% |

| Corrective Spectacles | 12% | 5% | -7% |

Affordable Education

The government has made education-related materials even more affordable by eliminating taxes on them.

| Items | From | To | Change |

|---|---|---|---|

| Maps, Charts & Globes | 12% | Nil | -12% |

| Pencils, Sharpeners, Crayons & Pastels | 12% | Nil | -12% |

| Exercise Books & Notebooks | 12% | Nil | -12% |

| Eraser | 5% | Nil | -5% |

Compare Old vs New GST Rates

Visual comparison of GST rate changes across different product categories

For a detailed comparison of all GST rates, you can use our online GST comparison tool.

Uplifting Farmers & Agriculture

The agricultural sector, the backbone of our economy, receives substantial support through these changes.

| Items | From | To | Change |

|---|---|---|---|

| Tractor Tyres & Parts | 18% | 5% | -13% |

| Tractors | 12% | 5% | -7% |

| Specified Bio-Pesticides, Micro-Nutrients | 12% | 5% | -7% |

| Drip Irrigation System & Sprinklers | 12% | 5% | -7% |

| Agricultural Machinery | 12% | 5% | -7% |

Automobiles Made Affordable

One of the most talked-about changes is in the automobile sector, aimed at boosting demand and making personal mobility more accessible.

| Items | From | To | Change |

|---|---|---|---|

| Petrol, Petrol Hybrid, LPG, CNG Cars (not exceeding 1200 cc & 4000mm) | 28% | 18% | -10% |

| Diesel & Diesel Hybrid Cars (not exceeding 1500 cc & 4000mm) | 28% | 18% | -10% |

| Three-Wheeled Vehicles | 28% | 18% | -10% |

| Motorcycles (150 cc & below) | 28% | 18% | -10% |

| Goods Transport Vehicles | 28% | 18% | -10% |

Save on Electronic Appliances

Large electronic appliances, often considered luxury items, have been brought down to a more reasonable tax slab.

| Items | From | To | Change |

|---|---|---|---|

| Air Conditioners (ACs) | 28% | 18% | -10% |

| Televisions (above 32″, including LED & LCD) | 28% | 18% | -10% |

| Monitors & Projectors | 28% | 18% | -10% |

| Dishwashing Machines | 28% | 18% | -10% |

For Business Owners: The Crucial Tally Connection

While the common man celebrates the savings, every business owner in India using Tally Prime or Tally.ERP 9 has a critical task at hand. Ensuring your accounting software reflects these new GST rates from 22nd September 2025 is non-negotiable for accurate invoicing, compliance, and claiming Input Tax Credit (ITC).

What Happens If You Don’t Update Tally?

- Incorrect Invoicing: You might charge the old, higher GST rates on invoices, overcharging your customers and losing competitive advantage.

- Compliance Issues: Your GSTR-1 (outward supplies) and GSTR-3B (summary return) will have incorrect data, leading to mismatches and potential notices from the GST department.

- ITC Reconciliation Problems: If you charge the wrong rate, your customers cannot claim the correct ITC, causing friction in your business relationships.

- Financial Loss: Overcharging customers or undercharging due to an incorrect setup can directly impact your profitability.

How to Manage the New GST Rates in Tally Prime (Step-by-Step Guidance)

Updating Tally for the new GST rates is a systematic process. Here’s how you can do it:

First, ensure you are on the latest release of Tally Prime. Tally Solutions typically releases updates soon after such government notifications to incorporate new tax rates. Go to F12 (Configure) > General > Update to check for and install the latest version.

This is the most important step. You need to review the GST rate applied to each of your stock items. 1. Go to Gateway of Tally > Inventory Info. > Stock Items > Alter. 2. Select the stock item you want to update (e.g., “Toothpaste”). 3. In the stock item creation screen, navigate to the Tax Information section. 4. In the GST Details tab, update the HSN/SAC code and the new Tax Rate (e.g., change from 18% to 5%). 5. Save the changes.

Ensure that your GST tax ledgers (e.g., CGST, SGST, IGST at 5%, 12%, 18%) are correctly created. In most cases, if you are on a updated version, these ledgers will already be available.

Before creating any actual invoices post-22nd Sep, create a few sample sales invoices for critical items. Print the invoice or check the PDF preview to double-check that the new GST rate is being applied correctly. This simple test can save you from major errors.

Make sure everyone in your team involved in invoicing and accounting is aware of the rate changes and the updated process in Tally.

We Are Here to Help You!

Transitioning to new tax structures can be daunting, especially if you have a large inventory. If you are unsure about any step, facing technical issues, or simply don’t have the time to manage this update yourself, our team of Tally experts is just a message away.

We can guide you through the process, help you bulk-update your items, or even remotely assist you in configuring Tally correctly for these new rates.

📧 Email us 💬 Join our WhatsApp groupFor a visual, step-by-step guide, we have a dedicated playlist on our YouTube channel that walks you through various Tally processes, including GST updates. Subscribe to our channel and watch the playlist here:

Tally GST Tutorial PlaylistConclusion: A Progressive Step Forward

The Next-Gen GST reforms are indeed a welcome move. By reducing the tax burden on essential items and simplifying the tax structure for key sectors, the government has taken a significant step towards easing the cost of living and stimulating economic growth.

For businesses, this is the time to be proactive. Embrace the change, update your systems, and pass on the benefits to your customers. An updated Tally is not just about compliance; it’s about accurate accounting and building trust with your clients.

Let’s welcome this festive season with lighter expenses and a more robust, compliant business system!