TallyPrime Release 5 : Revolutionizing GST Compliance and Reporting

The latest release from Tally Solutions, TallyPrime Release 5, is poised to transform the way businesses handle GST compliance and reporting. With a suite of advanced features aimed at streamlining GST processes, this release promises to enhance efficiency, accuracy, and ease of use. This article delves into the key features of TallyPrime Relese 5, exploring how it will benefit businesses and simplify GST-related tasks.

Introduction to TallyPrime Release 5

TallyPrime Release 5 represents a significant leap forward in Tally’s suite of business management software. Designed to integrate seamlessly with GST requirements, this release aims to address common challenges faced by businesses in managing GST data and compliance. By providing a connected GST experience, TallyPrime Release 5 helps businesses reduce manual efforts and errors, ultimately saving time and resources.

Auto-download GST Data

One of the standout features of TallyPrime Release 5 is its ability to automatically download GST data. This functionality encompasses GSTR-2A/2B, GSTR-1, and GSTR-3B data, which are critical for accurate GST reconciliation.

Benefits of Auto Download

- Efficiency: Automating data downloads reduces the need for manual data entry and minimizes the risk of errors.

- Time-Saving: Businesses can save significant time by avoiding the tedious process of manually fetching GST data from the GST portal.

- Accuracy: Automatic downloads ensure that the data is current and accurately reflects the latest transactions and adjustments.

Connected Services for GST Invoices and Returns

TallyPrime Release 5 introduces connected services that streamline the process of handling GST invoices and returns. This feature allows users to upload GST invoices and file returns directly within the TallyPrime interface.

Advantages of Connected Services

- Seamless Integration: Users can manage all GST-related activities within a single platform, reducing the need to switch between multiple systems.

- Ease of Use: The simplified process of uploading invoices and returns directly from TallyPrime minimizes the potential for errors and enhances user experience.

- Compliance: Ensures timely and accurate filing of GST returns, helping businesses stay compliant with regulatory requirements.

Direct Filing and Signing of GSTR-1

TallyPrime 5.0 makes GST compliance even more straightforward by allowing users to file and sign the GSTR-1 return directly from the software. This feature simplifies the filing process and ensures that businesses can meet their compliance deadlines with ease.

Key Benefits

- Convenience: Users can complete the entire filing process without leaving the TallyPrime environment.

- Reduced Complexity: Streamlined filing and signing procedures reduce the complexity and potential for errors.

- Timeliness: Ensures that returns are filed promptly, avoiding penalties and compliance issues.

Enhanced Outstanding Reports

TallyPrime 5.0 also features improved outstanding reports that provide valuable insights into ITC (Input Tax Credit) at risk. These enhanced reports are designed to help businesses better manage their GST-related financials.

Features of Enhanced Outstanding Reports

- Detailed Analysis: Provides a comprehensive view of outstanding GST amounts and ITC risks, allowing businesses to take proactive measures.

- Better Decision-Making: Enables informed decision-making by highlighting potential issues and opportunities related to GST credits.

- Improved Management: Facilitates better management of accounts receivable and payable, contributing to overall financial health.

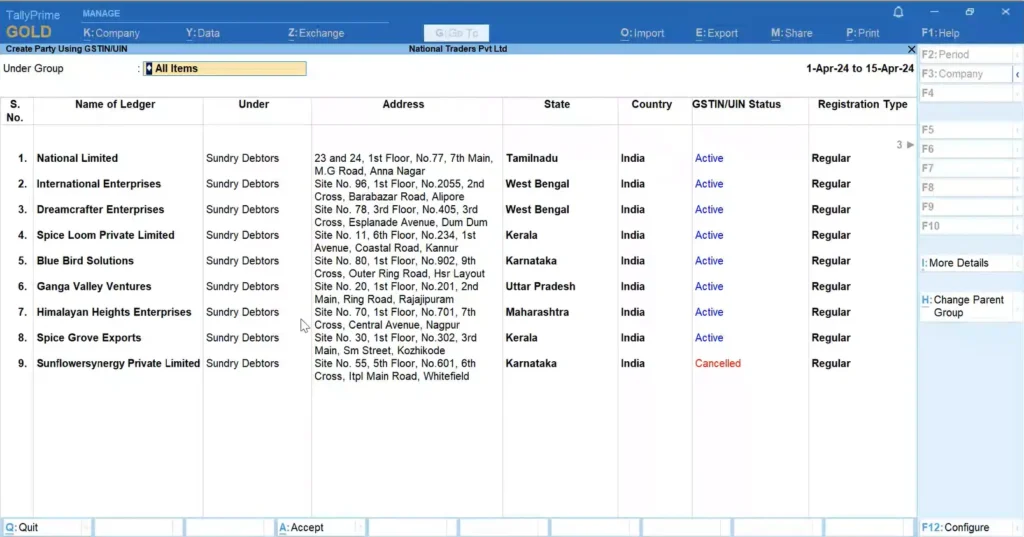

GSTN Integration

The integration with GSTN (Goods and Services Tax Network) in TallyPrime 5.0 is a game-changer for businesses. This feature allows users to fetch, validate, and create ledgers using GSTN, ensuring that all data is accurate and compliant with GST regulations.

Advantages of GSTN Integration

- Accuracy: Ensures that ledger data is accurate and up-to-date by validating it against the GSTN database.

- Compliance: Helps businesses maintain compliance with GST regulations by providing accurate and validated data.

- Efficiency: Streamlines the process of ledger management and data validation, reducing manual effort and potential errors.

Stripe-View in Reports

TallyPrime 5.0 introduces the Stripe-View feature in all reports, enhancing the way users analyze and interpret data. This new view option provides a more intuitive and user-friendly way to interact with reports.

Benefits of Stripe-View

- Enhanced Usability: Makes it easier for users to navigate and understand reports with a cleaner and more organized layout.

- Improved Analysis: Facilitates better data analysis by presenting information in a more accessible format.

- Visual Clarity: Provides visual clarity, making it simpler to identify trends, patterns, and anomalies in financial data.

Conclusion

TallyPrime 5.0 represents a significant advancement in business management software, particularly in the realm of GST compliance and reporting. With features like auto-download of GST data, connected services for GST invoices and returns, direct filing and signing of GSTR-1, enhanced outstanding reports, GSTN integration, and Stripe-View in reports, this release offers a comprehensive solution for modern businesses.

By streamlining GST processes and enhancing data accuracy, TallyPrime 5.0 empowers businesses to focus on their core operations while ensuring compliance with GST regulations. As businesses continue to navigate the complexities of GST, TallyPrime 5.0 stands out as a valuable tool for achieving efficiency, accuracy, and compliance in an ever-evolving regulatory landscape.

If you are wondering where the right place is to purchase TallyPrime 5.0, contact us We have been Tally Certified Partner since 2005, and we have approximately 1500 happy client, You can check our YouTube channel link for more details: https://youtu.be/pmL3q0iBOpE?si=iOobLFF6mxvUzyl6

if you want to Contact us, click at this link: https://hardwaresoftware.in/contact-us/

TallyPrime 5.0 is Really Great for Accounting and GST Return

Enhance reporting, multi language printing